Entertainment on a Budget: Enjoying Life for Less

Picture a lively social life. Try new hobbies and make memories without breaking the bank. Sounds like a dream, right?

The great news is: you can live your best life without spending a fortune. With creativity and planning, you can find fun, meaningful, and budget-friendly experiences.

This guide is for students, young professionals, and anyone wanting to save money. It shows how to enjoy fantastic entertainment on a budget, easily.

Why Entertainment Spending Matters

The Hidden Cost of “Just Having Fun”

A £10 cinema ticket, a £20 concert, a £7 coffee catch-up — individually, they feel harmless. But without realising, they add up quickly.

Reality Check: A 2023 survey by the Money Advice Service found that UK adults spend over £250 a month on leisure activities. That adds up to more than £3,000 a year!

That’s enough to fund:

- A luxury two-week European trip

- A new tech upgrade (laptop, phone)

- A serious boost to your emergency fund or house deposit

Key Lesson: Entertainment is essential, but mindless spending isn’t.

Setting an Entertainment Budget

Use the 50/30/20 Rule

The 50/30/20 rule is a simple and robust method:

- 50% of income → essentials (rent, food, transport)

- 30% of income → wants (including entertainment)

- 20% of income → savings/debt repayment

Example: If your take-home salary is £2,000/month:

- £1,000 for essentials

- £600 for discretionary spending (entertainment, hobbies, dining out)

- £400 towards savings and debts

This guideline allows you to have fun without guilt. You can enjoy yourself while also staying financially healthy.

Mini-Tip: Use a budgeting app like Monzo, YNAB, or even a spreadsheet to track your monthly spending. You’ll quickly spot patterns and find ways to trim excess.

Affordable Fun Ideas: Rich Experiences for Less

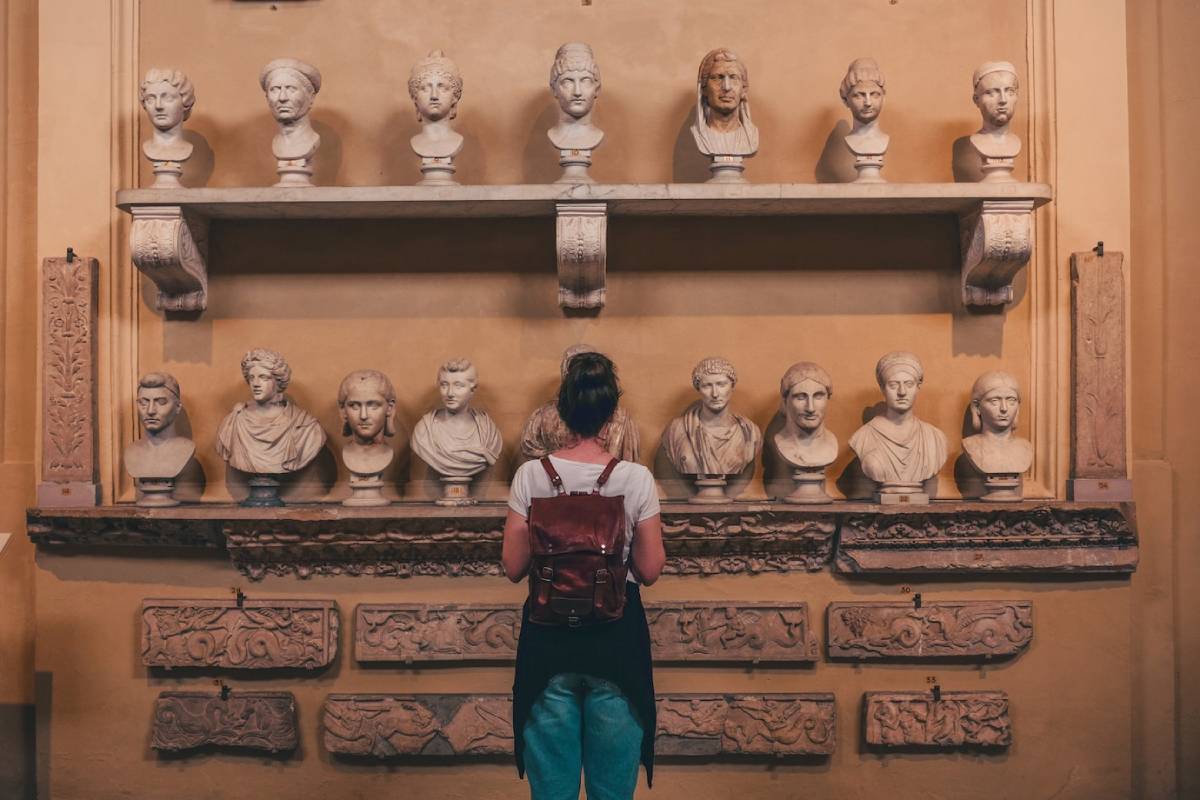

1. Explore Free Events in Your City

You might be missing out on a treasure trove of free activities:

- Free museum entry days

- Street festivals and carnivals

- University art exhibitions

- Free public lectures and workshops

Where to find them:

- Local council websites

- Facebook “Events Near Me”

- Eventbrite (filter by free events)

- MeetUp.com

Pro Tip: Join local groups on Facebook or WhatsApp. They often share events that aren’t advertised.

2. Host DIY Entertainment at Home

Transform your living space into the ultimate entertainment hub.

Ideas:

- Potluck Dinners: Each guest brings a dish that is affordable and delicious.

- Themed Movie Nights: 80s Night, Disney Marathon, Scary Movie Saturday.

- Karaoke Party: YouTube has countless karaoke tracks — no machine needed.

- Board Game Tournaments: Share your favourite classic games. Also, try free mobile games for more fun!

Bonus: Home-based fun strengthens friendships while costing a fraction of a night out.

3. Embrace Public Parks and Nature

Nature is the ultimate free entertainment.

Options include:

- Sunrise hikes

- Weekend picnics

- Outdoor yoga

- Public beach days

- Volunteering for conservation walks or local cleanups

Mental Health Bonus: Studies show regular time outdoors reduces stress and boosts happiness!

4. Volunteer at Festivals and Events

Love music, food, or cultural festivals? Volunteer for a few hours — attend the rest for free.

Common perks:

- Free entry

- Behind-the-scenes experiences

- Meeting performers or organisers

Top Sites:

- Join the “Volunteer at Festivals UK” groups on Facebook

- Search individual festival websites for volunteer opportunities

Saving on Popular Paid Entertainment

1. Stream Smarter

Instead of piling up multiple subscriptions:

- Rotate platforms monthly (Netflix one month, Disney+ the next)

- Share family or group plans (many platforms allow it)

- Set a calendar reminder to cancel free trials before billing kicks in

Quick Win: Ask yourself: Am I watching this service enough to justify it?

2. Save Big on Cinema Trips

Cinemas don’t have to be expensive!

- Look for student/young adult discounts.

- Join loyalty schemes like Odeon Limitless or Cineworld Unlimited

- Attend weekday matinees — often half the price of evening shows

Snack Hack: Buy candy or popcorn at the store first (if you can). This is cheaper than buying snacks at the cinema.

3. Get Discounts on Experiences

Deal sites like Groupon, Wowcher, and Secret London often offer:

- Half-price spa days

- Discounted escape room tickets

- Meal-for-two deals at top restaurants

Rule: Be flexible on dates/times to unlock the best bargains.

Smart Leisure Savings Hacks

Always Plan Ahead

- Budget for significant events (festivals, theatre tickets) months ahead

- Sign up for early-bird tickets

- Set calendar alerts for deal days like Black Friday, Cyber Monday, or Travel Tuesday

Use Cashback and Rewards

Earn money while spending:

- Quidco and TopCashback for online ticket bookings

- Airtime Rewards for real-world shopping

Mini-Win: Some apps offer £5–£20 signup bonuses — free entertainment cash just for joining!

Join Loyalty Clubs

Many places reward regular customers:

- Local cafés offering free drinks after a few visits

- Cinemas providing free movie tickets for points

- Museums offering discounted annual passes

Example: National Trust membership = unlimited free access to hundreds of parks and properties.

The Psychology of Budget Entertainment

Why “Affordable Fun” Feels Better

Spending intentionally creates more satisfaction and deeper memories.

You’ll remember:

- The laughter at a homemade pizza night

- The thrill of a free street festival

- The pride of smart savings

Mindset Shift: Budget living isn’t about losing joy. It’s about creating meaningful experiences.

Real-Life Success Story: Olivia’s Year of Budget Fun

Meet Olivia, a 24-year-old graphic designer from Manchester.

Starting point:

- Spending over £400/month on concerts, streaming, cafés

After the shift:

- Cancelled two underused streaming services

- Hosted monthly dinner parties instead of expensive nights out

- Used cashback apps for all entertainment bookings

Outcome:

- Saved £2,100 over 12 months

- Funded a dream trip to Italy without touching her savings

Olivia’s Insight:

“I didn’t lose out on fun. If anything, it became richer because every experience felt intentional and earned.”

Common Entertainment Budget Mistakes to Avoid

- Impulse ticket buying: Always wait 24 hours before purchasing expensive events.

- Subscription overload: Audit your subscriptions every 3 months.

- No “fun fund”: Plan your budget ahead. It’s easier to manage spontaneous spending when you prepare for it.

- Ignoring loyalty and cashback apps: They do add up faster than you think!

Conclusion: Smart Fun = Financial Freedom

Entertainment is essential — it keeps life vibrant, joyful, and connected. But overspending on fun leads to future regret.

Use these budget entertainment tips to enjoy life and keep your finances safe.

Ready to take charge?

- List 3 free or cheap activities to try this month.

- Review your subscriptions and cancel one you don’t need.

- Plan for one paid event and find a discount code for it.

Challenge:

Enjoy more fun experiences this year — and finish it wealthier, wiser, and happier!