Top Budgeting Apps for Young Adults

If you’ve ever thought, “Where did all my money go this month?” — you’re not alone. Managing your finances can feel overwhelming when you’re just starting. The good news? The right budgeting apps can turn a financial mess into clear plans. They make managing money easier, more innovative, and even enjoyable.

Today, we’re diving into the treasure chest of financial tools for young adults. These handy apps help you track spending, set goals, and elevate your finances — all from the palm of your hand.

Why Budgeting Apps Are a Game-Changer for Young Adults

Let’s be honest: traditional spreadsheets aren’t everyone’s cup of tea. Budgeting apps offer something better:

Key benefits:

- Real-time tracking of your income and expenses

- Automatic categorisation of spending

- Savings and debt repayment goals you can visualise

- Instant insights and alerts to help avoid overspending

Quick Insight: Budgeting apps are like personal trainers for your money. They guide you, motivate you, and help you stay financially fit!

What to Look for in a Great Budgeting App

Before you jump into downloading, here’s what truly matters:

Essential features:

- User-friendly interface: Clear, not cluttered.

- Customisable categories: Tailor it to your lifestyle.

- Goal-setting tools: Help you visualise your progress.

- Bank account syncing: Secure and automatic updates.

- Top-notch security: Bank-level encryption for your data.

Nice-to-have bonuses:

- Bill reminders

- Investment tracking

- Credit score monitoring

- Subscription management

Tip: Pick a tool that fits your style and goals, not just what’s popular.

Best Budgeting Apps for Young Adults

Here’s a breakdown of the top apps that balance functionality, accessibility, and motivation:

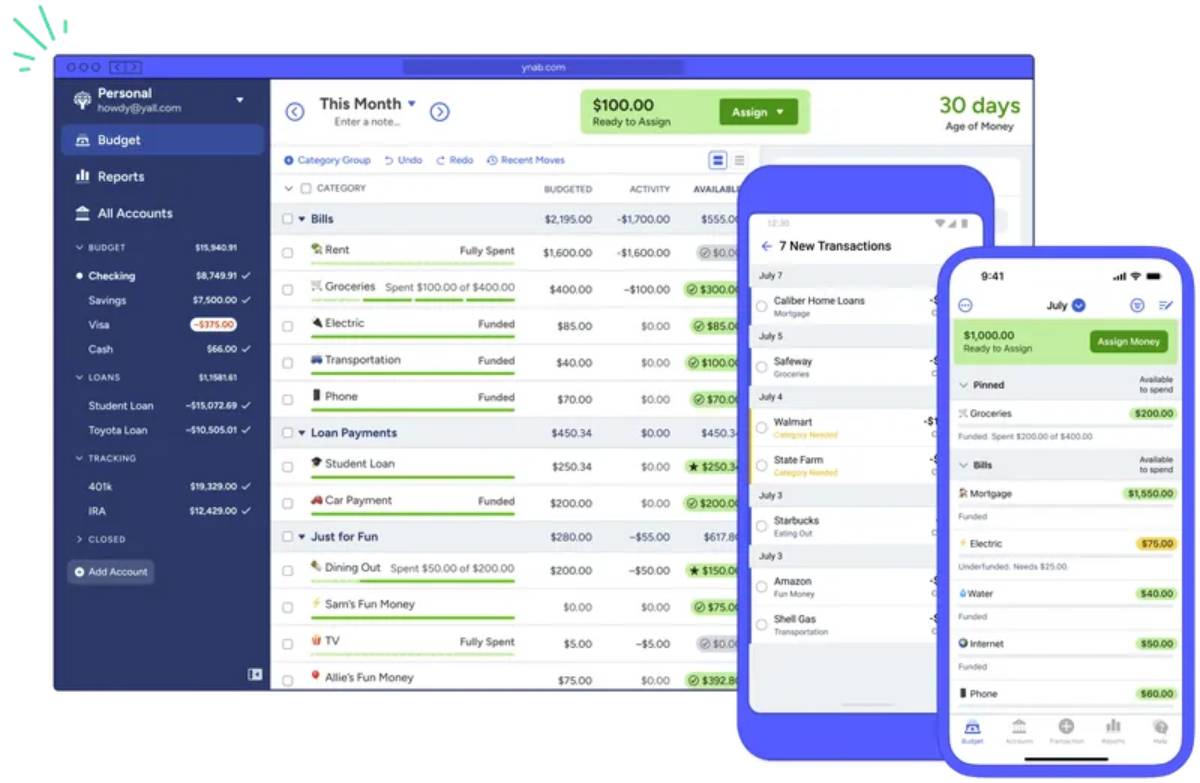

1. YNAB (You Need A Budget)

Best for: Proactive budgeting and building financial habits from scratch.

Highlights:

- Follows a zero-based budgeting system: every pound gets a job.

- Encourages goal setting and mindful spending.

- Offers financial education resources and a supportive community.

Cost:

- 34-day free trial

- £79.99/year after the trial

Real-World Story: A university grad, Alex, saved £1,500 for a laptop upgrade in less than six months. He did this by tracking his spending with YNAB.

Pro Tip: YNAB is ideal if you want to rewire how you think about money completely.

2. Monzo

Best for: Everyday money management combined with full-service banking.

Highlights:

- Set spending targets per category.

- Create “Pots” to save separately for holidays, rent, or emergencies.

- Receive instant notifications for spending.

- Real-time control over your account with freeze/unfreeze card features.

Cost:

- Free basic account

- Plus (£5/month) and Premium (£15/month) upgrades for added features

Tip: Jess, a 25-year-old freelancer, saved for taxes and holidays with Monzo Pots. This helped her avoid last-minute stress.

3. Emma

Best for: Visual insights and subscription management.

Highlights:

- Connects multiple bank accounts and credit cards.

- Tracks recurring subscriptions and spots forgotten ones.

- Offers spending breakdowns across all categories.

Cost:

- Free basic version

- Emma Pro from £4.99/month for advanced features

Why It’s Great: Emma is great for fighting subscription creep. It helps stop that sneaky drain on your bank account.

4. Snoop

Best for: Finding money-saving opportunities easily.

Highlights:

- Tracks bills and spending trends.

- Suggests cheaper providers for insurance, utilities, and more.

- Personalised tips based on your financial behaviour.

Cost:

- Free (with optional paid upgrades)

Top Insight: Snoop acts like a friendly financial advisor in your pocket. It’s perfect for those who love saving but want to avoid the hard work.

5. Moneyhub

Best for: Comprehensive financial tracking and planning.

Highlights:

- Syncs with bank accounts, pensions, and investments.

- Tracks net worth over time.

- Provides detailed cash flow projections.

Cost:

- £1.49/month or £14.99/year

Why Choose It: If you want to build wealth for the long term, Moneyhub is a strong choice.

How to Choose the Right Budgeting App for You

Ask yourself:

- Do I need simple expense tracking or complete financial planning?

- Will I pay for extra features if they save or grow my money faster?

- Is secure bank syncing a must-have for me?

Strategy:

- Test a few apps during free trials.

- See which interface feels easiest to maintain consistently.

- Stick with the app that feels most empowering, not overwhelming.

Top Tips for Using Budgeting Apps Effectively

1. Check Weekly, Not Just Monthly

A weekly review (e.g., every Sunday evening) keeps spending leaks from becoming full floods.

2. Set Realistic Budgets

Overshooting your savings or cutting your grocery budget too tight leads to frustration. Aim for sustainable improvement.

3. Enable Spending Notifications

Instant alerts when you’re close to category limits help prevent accidental overspending.

4. Regularly Review Subscriptions

Use your app’s insights to cancel unused services. You might be shocked how quickly £5–£10 subscriptions add up!

5. Celebrate Milestones

Saved your first £500? Paid off a credit card? Mark it! Positive reinforcement builds stronger financial habits.

Real-Life Story: Jess’s Financial Turnaround

Jess, a 25-year-old graphic designer, struggled with inconsistent freelance income. After six months with Monzo:

- She created dedicated Pots for taxes, holidays, and rent.

- Built a £2,000 emergency fund.

- Cut “accidental spending” by £100/month.

Her reflection?

“Tracking every pound was annoying at first, but after a while, it felt powerful. I finally felt in control.”

Common Mistakes to Avoid

- Setting unrealistic goals: Build habits gradually.

- Ignoring irregular income: Freelancers must budget differently.

- Relying on memory alone: Apps track what the brain forgets.

- Overlooking app security: Only use apps with strong encryption and verified privacy policies.

Frequently Asked Questions

Are free budgeting apps safe?

Reputable apps use bank-grade encryption and read-only access. Always review an app’s security policy before connecting your accounts.

Should I connect all my accounts to a budgeting app?

Yes — for the most accurate financial snapshot. But only if you’re comfortable with the app’s security standards.

Can budgeting apps help save for big goals?

Absolutely! Many apps let you track your goals, which can help you save for travel, gadgets, emergencies, or major life changes.

Conclusion: Take Charge of Your Financial Journey

Taking charge of your finances begins with insight. The perfect budgeting app can turn chaos into clarity and stress into strength.

Eager to seize the reins of your finances? Download our app today! Set your inaugural savings goal, and witness your financial confidence blossom. With each savvy choice, you’re crafting a brighter future.